Kenya N. Rahmaan

As millions of Americans celebrated the Presidential victory of two-term Commander-in-Chief Donald J. Trump in the November 2024 election, meticulous workers in the background prepared to cast a groundbreaking vote. Electing a Republican president was a massive victory for conservatives for several reasons. However, a thirty-year mission would finally become a reality, and it began with the 1996 welfare reform bill. While MAGA supporters celebrated and Harris supporters groaned, a heist was underway, but no weapons or ski masks were needed.

President-elect Trump’s announcement about the induction of South African billionaire and businessman Elon Musk to his cabinet astonished those who had vied with dedication for similar considerations. Musk was accepted with open arms by the same constituency that wanted desperately to oust any foreign-born person residing on American soil. Amidst his warm American welcome, Musk was tasked with leading a new government agency to investigate wrongdoing, primarily financial, in official government agencies. The unofficial agency, the Department of Government Efficiency (DOGE), was determined to decrease government spending by hiring a billionaire as its overseer.

Despite the irony of hiring for government jobs while simultaneously firing government employees from essential positions, DOGE, under the direction of the Tesla mogul, is resolute in its mission to eradicate fraud in the federal government. John and Jane Q. Public remained silent even when a picture made headlines on social media of Elon Musk entering the Federal Office of Child Support Services (OCSS), formerly the Office of Child Support Enforcement (OCSE), in March of 2025. When people started reacting to the photo-op, there was sheer excitement at the idea of the Trump Administration, headed by a father who was in the midst of his own child support battle, appearing to finally dismantle the system responsible for allegedly destroying lives. A little homework about the child support program would have told spectators that two exceedingly wealthy and powerful aristocrats would not touch America’s golden goose.

According to the FY 2024 Office of Child Support Services’ Report to Congress, state and tribal agencies reported 11,646,025 Title IV-D cases and caseloads nationwide. The preparers were careful to separate the caseloads that never received public assistance (non-Title-IV-D, Medicaid-only, and Tribal cases, which added 4,389,696, 6,383,122, and 1,932,684, respectively. Each jurisdiction receives incentive payments each fiscal year when the following performance measures are met and exceeded:

- Paternity establishment

- Order establishment

- Current support collections

- Collections on arrears,

- and cost effectiveness.

The Internal Revenue Service (IRS) serves as an invaluable partner in the effort to collect past-due support through the offset of federal income tax refunds—the exchange of federal taxpayer information (FTI) for child support purposes. The Office of Child Support Services (OCSS, 2023) explained that if a child support debt meets the federal requirements for a federal tax refund offset (at least $150 for Title IV-D cases and $500 for non-Title IV-D cases), the parent will receive a Pre-Offset Notice. The notice discloses personal information that is considered confidential by the United States Treasury Department. The IRS is the catalyst for Elon Musk’s mysteriously cloaked trip to the child support office.

The traditional procedures would begin with the agency sending a Pre-Offset notice to parents informing them of the upcoming garnishment from their tax refund. The notice is considered adequate due process for the counterbalance, and the parent has the right to appeal the proposed refund deduction. The discrepancy that prompted the DOGE visit concerns the information that OCSS transfers to the IRS regarding debtors. The Administration for Children and Families (2023) writes that information sent to the Department of the Treasury includes the name, Social Security number, and past-due child support amounts.

The Personally Identifiable Information or PII is transmitted to intergovernmental personnel for debt collection purposes; however, the federal government has long sought to contract debt collections to the private sector. Unfortunately, child support reform, or more specifically, Title IV-D of the Social Security Act, was never on the agenda. What was on the forecast had nothing to do with secret database clouds or foreign appointees accessing encrypted financial information for space travel. The actual reason for the breach was the oldest motive in the world. Money.

In 1999, politicians joined a bipartisan effort to guarantee legislative writers included corrective measures in the language to comply with the IRS confidentiality regulations and allow for maximum child support collections. After all, in the late 1990s, Uncle Sam was fully aware of the profitability of exploiting tax refund offsets. Former President Bill Clinton signed the Personal Responsibility and Work Opportunity Act (PRWORA) in 1996, reforming the welfare system. The Reformation, influenced by former President Ronald Reagan, started with his signature on the 1988 Family Support Act.

The PWRWOA strengthened the Family Support Act; legislators were meticulous in intertwining child support enforcement measures with the Temporary Assistance for Needy Families (TANF). The extra punishments and sanctions for noncooperation and nonpayment to the child support program were missing from the Aid to Families with Dependent Children (AFDC). On January 1, 1999, tax refund offsets secured by the Department of the Treasury began to “commingle” with other federal financial information, such as benefit payments and pensions. https://www.youtube.com/watch?v=q008zdl96p0 The IRS Publication 1075 details how agencies were required to provide a Safeguard Procedures Report or SPR before they could receive PII or Federal Tax Information (FTI).

Considering that Title IV-D and TANF are complementary to one another, the regulations and criteria for contractor access to taxpayer information differ from those of other programs. The employees are not granted congressional permission under 6103 (1)(6) that allows contractors access to taxpayer information. At the time of the analysis above, the recommendation of the writers was to amend 6103 (1)(7) to permit tribes, charitable, religious, or private organizations to allow contractors permission to access specific taxpayer information IF they complied with the same safeguards government employees were required to follow. Government employees would find it tremendously difficult, if not impossible, to determine the amounts of money illegally seized through garnishments and tax refund offsets executed by government agencies each year.

The internet buzzed as the image of Musk confidently storming the child support office steps with the vigor of a man on a mission. Although ambitious in its appearance, taxpayers could easily believe that one of the most controversial and profitable Federal programs would finally meet its day of reckoning. President Trump appointed Elon Musk as an SGE, or a ‘Special Government Employee.’ According to Joe Hernandez from NPR (2025), an SGE is a designation given to individuals who join the government for a short period, typically to provide specialized expertise.

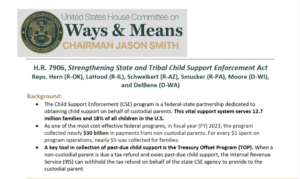

While technically not a civilian contracting to work as a government representative or employee, Musk raised questions from government officials about his authority and credentials that granted him access to taxpayer data and confidential information. Government officials held numerous committee meetings throughout the decades in an effort to find the smallest loophole to implement the most cost-effective collection costs while maintaining taxpayer confidentiality. The extension allowed the originator of H.R. 7906, Representative Kevin Hern (R-OK-1), to present his argument for circumventing the IRC regulations for decades. According to the CRS 22, The 118th Congress introduced H.R. 9076, which provided that the bill would amend Section 464 of the SSA to explicitly provide that the FOP authorities apply to tribal IV-D programs. In other words, the original bill, H.R. 7906, did not contain enough loopholes and satisfactory wordplay to fool the Treasury Department and the IRS auditors.

The changes, unfortunately, will not repeal Title IV-D of the Social Security Act as some Fathers’ Rights and Shared Parenting groups like to advertise across social media. Parents can look forward to an expansion in who can establish, collect, and enforce child support orders. The bill collector, traditionally a position held by government employees due to confidentiality concerns, will be filled by civilian contractors. Civilian contractors are not held to the same code of conduct and governmental collection standards as government employees.

At the time of this article, officials from the Department of the Treasury and the Internal Revenue Service have not responded to the passage of H.R. 9076. The silence that has followed the clear and present violations against parents and child support debt will be addressed in the next step, which will include any person owing any debt to the United States Government. The bill collector, traditionally a position held by government employees due to confidentiality concerns, will be filled by civilian contractors. Civilian contractors are not held to the same code of conduct and governmental collection standards as government employees. HR-7906-Section-by-Section

There are also no new confidentiality guidelines for reporting violations, which are enough to ensure that taxpayer information is safe from unauthorized access and possible fraud and abuse. Only time will tell how long the Treasury Department will allow the decades-old rule of no contractor access to stand when it comes to tax refunds for child support debt collection. The IRS will have to initiate a counteraction to block H.R. 9076 if the agency is serious about taxpayer confidentiality. Until then, the Senate and House, after half a century, are the victors.

References:

Hernandez, J. (2025, February 13). Trump hired Musk as a ‘special government employee.’ Here’s what that means. NPR Illinois. https://www.nprillinois.org/2025-02-13/trump-hired-musk-as-a-special-government-employee-heres-what-that-means

Office of Child Support Services Files. (2025). FY 2024 preliminary data report and tables. Welcome To ACF | The Administration for Children and Families. Retrieved October 9, 2025, from https://acf.gov/css/policy-guidance/fy-2024-preliminary-data-report-and-tables

Office of Child Support Services. (2023, June 2). How does a federal tax refund offset work? Welcome To ACF | The Administration for Children and Families. https://acf.gov/css/faq/how-does-federal-tax-refund-offset-program-work

Office of Child Support Services. (2025, April 7). When is a child support case eligible for the federal tax refund offset program? Welcome To ACF | The Administration for Children and Families. Retrieved October 10, 2025, from https://acf.gov/css/faq/case-eligible-federal-tax-refund-offset-program