As penalties and punishments for nonpayment of child support become more commonly known, it is vital to discuss credit scores as they relate to child support delinquencies. The government can and will do everything in its power to discredit a person in regards to collecting child support from parents. Discrediting includes posting most wanted billboards around a city or plastering a parent’s photo on a pizza box that may end up delivered to a debtor’s child. There seems to be nothing left sacred in the pursuit of money from parents.

As non-custodial parents (NCPs) are subject to professional, recreational, and driver’s license suspensions, credit reporting is another punishment that can halt any progression towards financial stability for that same parent. The government must report child support delinquencies to the credit reporting bureau, which lowers a parent’s credit score. According to the Administration for Children and Families or ACF, federal law mandates that states periodically report the names of non-custodial parents who have delinquent payments. This reporting has an immediate negative impact on these parents concerning any significant financial transactions.

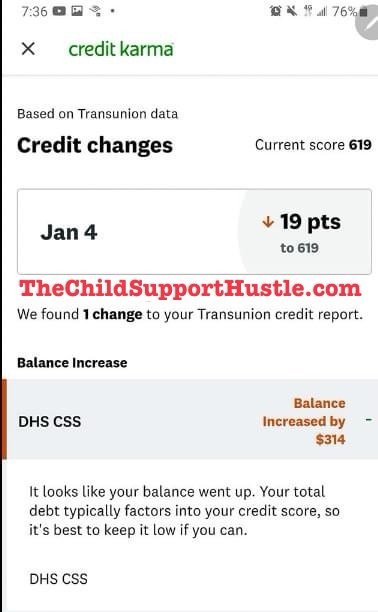

The child support delinquency and all other information concerning the missed payment appear on the credit report. The states must report the amount a parent owes in arrears (ACF). Arrears, in my opinion, should not be included in the credit bureau reporting because these are added charges and have nothing to do directly with the child support payment. Including arrears on the credit report can instantly increase a $1,000 debt to any amount submitted by the state agencies.

Arrears can quickly accumulate to tens of thousands of dollars on what could be a couple of missed one hundred dollar payments. It is unfair that a parent who may be too poor to pay excessive child support debt should be penalized by adverse credit bureau reporting. One could argue that negative credit reporting is not as severe as license suspensions or a prison sentence. On the contrary, negative credit reporting can be significantly worse for NCPs.

Poor credit can impact a person’s ability to find a job, rent an apartment, orobtain insurance (ACF). Parents can be penalized for failure to maintain insurance for children, which may be hindered by the credit reporting process. Just as importantly, most parents have low or no income, so penalties such as credit bureau reporting can be the deciding factor between having shelter and becoming homeless. Many employers conduct credit investigations before offering employment to an applicant.

According to Blake Ellis of CNN Money (2013), one in ten unemployed Americans has been denied a job due to information in their credit reports. Reporting child support delinquencies is counterproductive for parents trying to find gainful employment and are denied because of unfavorable credit reporting. There is no discrimination as to what employees are subject to credit inquiries before being offered job opportunities by potential employers. Credit checks are conducted for all kinds of positions, from entry-level to senior management (Ellis, 2013).

Whether a parent has missed many payments or one that has fallen on hard times because of the recent economic downturn, all parents face the same type of repercussions relating to reporting child support delinquency and punishments. It is contradictory to label a parent as a ‘deadbeat’ and, at the same time, destroy any prospects that are available to them to earn a living and pay support. License suspensions and incarcerations yield no significant child support collections, and credit reporting seems to join in that category. These punishments are not only harsh but they cannot possibly be expected to force parents to pay support both on time and in full.

Instead of creating more punishments for parents that cannot afford the exaggerated child support arrears, more jobs need to be created. There was a total of $2,961,152,421 of undistributed collections from 2009 to 2013 in all 50 states (Office of Child Support Enforcement). The government could easily use this money to develop jobs and help further education instead of incarcerating parents, suspending licenses, and reporting delinquent parents to credit bureaus. Distributing the names of late parents to credit bureaus should be eliminated, mainly because it impedes parents from finding gainful employment. It is impossible to expect a parent to obtain employment and meet all financial obligations with a child support noose tightened around their neck daily.

The credit reporting travesty is yet another strike against non-custodial parents, which adds to an already difficult situation. When parents use all the money they can earn to pay old child support debt, millions of children will never receive a dime. The parents, in turn, will be paying child support debt until they hit the lottery or die (whichever comes first). The punishments used to collect child support payments and obligations are not executed in the children’s best interest. It is, undoubtedly, a system that operates in the best interest of the state and federal government. The system needs to be reformed desperately.

References:

Administration for Children & Families. (n.d.). Assets for Independence Resource Center. Retrieved from

Ellis, B. (2013, December 17). New bill aims to stop employers from conducting credit checks – Dec. 17, 2013. Retrieved from http://money.cnn.com/2013/12/17/pf/employer-credit-checks/

Office of Child Support Enforcement. (2014, April 1). FY2013 Preliminary Report – Table P-16 | Office of Child Support Enforcement | Administration for Children and Families. Retrieved from